BTC Price Prediction: Analyzing the Path to $116K and Beyond Through 2040

#BTC

- Technical Strength: Price above key moving averages with Bollinger Band support suggests continued upward momentum toward $116K resistance

- Institutional Momentum: Major purchases by MicroStrategy, new fund launches, and corporate adoption creating sustained demand pressure

- Macro Tailwinds: Federal Reserve rate cut expectations and traditional finance flaws enhancing Bitcoin's value proposition as hedge asset

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

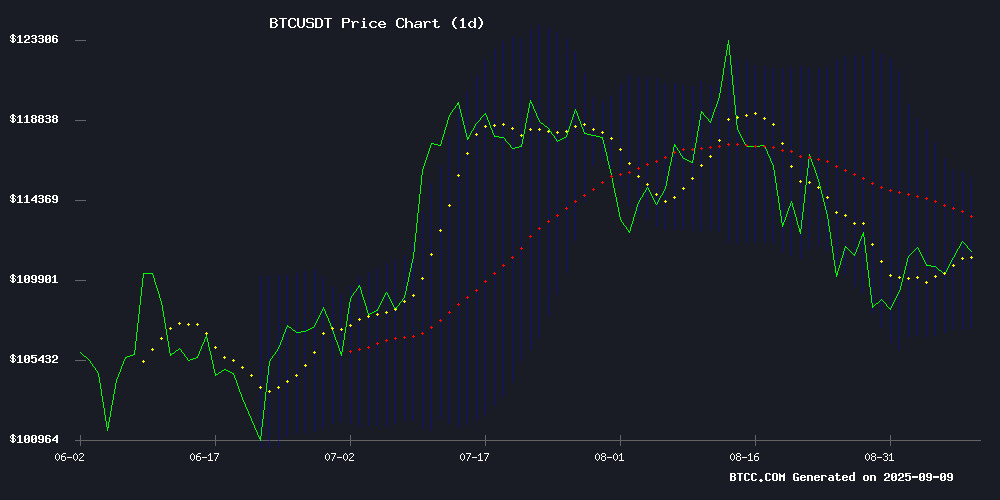

BTC is currently trading at $112,094, comfortably above its 20-day moving average of $111,428, indicating sustained bullish momentum. The MACD reading of -940 suggests some near-term consolidation, but the price holding above the middle Bollinger Band at $111,428 demonstrates underlying strength. According to BTCC financial analyst Emma, 'The technical setup supports a potential test of the upper Bollinger Band at $115,664 if buying pressure continues. Maintaining above the 20-day MA is crucial for the bullish narrative.'

Market Sentiment: Institutional Adoption and Macro Factors Fuel Optimism

Positive catalysts dominate the news flow, with Metaplanet's Bitcoin strategy yielding nearly 500% YTD returns and MicroStrategy's additional $217 million purchase reinforcing institutional confidence. El Salvador's symbolic purchase anniversary and Cantor Fitzgerald's new Bitcoin fund with gold hedging further validate the asset class. BTCC financial analyst Emma notes, 'While regulatory concerns persist with the D.C. AG lawsuit and Athena Bitcoin legal action, the overwhelming institutional momentum and Fed rate cut speculation are creating a fundamentally bullish environment that aligns with our technical outlook.'

Factors Influencing BTC's Price

Traditional Finance's Property Rights Flaws Highlight Crypto's Value Proposition

World Liberty Financial's examination of traditional finance reveals systemic vulnerabilities in property rights enforcement. The 2009 Selectica case demonstrates how even in advanced markets like U.S. equities, shareholders can be forcibly divested without compensation through mechanisms like poison pills.

This fundamental weakness in TradFi systems directly inspired Bitcoin's creation. As Satoshi Nakamoto's foundational quote emphasizes, cryptocurrency eliminates the need for trusted third parties while ensuring secure transactions and immutable ownership rights.

The Delaware court's sanctioning of Selectica's share redistribution underscores why decentralized finance emerged as an alternative. Blockchain-based systems codify property rights through smart contracts and cryptographic proof rather than fallible legal interpretations.

Metaplanet's Bitcoin Strategy Fuels Near 500% YTD Yield Surge

Metaplanet's year-to-date yield has skyrocketed to nearly 500%, fueled by aggressive Bitcoin accumulation. The Tokyo-based investment firm added 136 BTC ($15.2 million) to its treasury this week at an average price of $111,000 per coin, bringing total holdings to 20,136 BTC worth approximately $2.057 billion.

The company's Bitcoin-centric strategy continues delivering exceptional shareholder returns, with YTD gains reaching 487%. Metaplanet recently secured shareholder approval to raise $884 million through overseas share issuance, signaling further crypto treasury expansion. This follows last week's purchase of 1,009 BTC for $112 million that pushed holdings past the 20,000 BTC milestone.

While Metaplanet builds its Bitcoin war chest, on-chain data reveals long-term holders have offloaded 241,000 BTC over the past month. The divergence highlights growing institutional adoption amidst retail investor caution during Bitcoin's price recovery phase.

El Salvador Commemorates Bitcoin Law Anniversary with Symbolic Purchase

El Salvador marked the fourth anniversary of its pioneering Bitcoin Law by acquiring 21 BTC, a symbolic nod to the cryptocurrency's 21 million supply cap. President Nayib Bukele announced the purchase, bringing the nation's reserves to 6,313 BTC—valued at over $702 million. The move reinforces the country's commitment to Bitcoin despite external pressures.

Since 2021, El Salvador has stood as a global crypto leader by adopting Bitcoin as legal tender alongside the U.S. dollar. The policy aimed to enhance financial inclusion and reduce remittance costs, a lifeline for many Salvadorans. While praised for innovation, critics warn of economic volatility risks.

The International Monetary Fund has emerged as a key challenger to El Salvador's Bitcoin strategy. A $1.4 billion loan agreement in December 2024 forced policy adjustments, including making public-sector Bitcoin acquisitions voluntary rather than mandatory.

Bitcoin Bulls Target $116K Amid Fed Rate Cut Speculation

Bitcoin's price trajectory is drawing renewed optimism as traders eye a potential breakout toward $116,000. The cryptocurrency currently trades at $111,917, buoyed by shifting macroeconomic winds and technical indicators hinting at growing bullish momentum.

Market sentiment has turned decisively risk-on following weak U.S. employment data, with traders now pricing in a 100% probability of September rate cuts. This macroeconomic pivot coincides with Bitcoin's technical setup showing neutral RSI readings at 48 and a bullish MACD crossover - classic precursors to potential upward moves.

Trading volumes remain robust at $25.57 billion, suggesting institutional players are actively positioning for what could become Bitcoin's next leg toward all-time highs. The $116,000 level now emerges as critical resistance that could either confirm or deny the bullish thesis.

D.C. AG Sues Bitcoin ATM Operator Over Alleged Fraud Enablement

Washington D.C.'s Attorney General has filed a lawsuit against Athena Bitcoin, one of the largest crypto ATM operators in the U.S., accusing the company of knowingly facilitating fraudulent transactions. Investigators claim 93% of deposits through Athena's machines were linked to scams targeting seniors, with hidden fees reaching 26% per transaction.

The lawsuit alleges Athena ignored clear red flags in its internal data while profiting from the fraudulent activity. The company's seven Bitcoin ATMs in the District reportedly became a preferred tool for criminals due to perceived lax oversight, creating what officials describe as an 'unchecked opportunity for illicit international fraud.'

Authorities emphasize that Athena continued operating despite overwhelming evidence of criminal abuse, refusing refunds to victims while collecting substantial fees. The case highlights growing regulatory scrutiny of cryptocurrency infrastructure providers and their role in financial crimes.

Cantor Fitzgerald Launches Bitcoin Fund with Gold Hedge

Wall Street powerhouse Cantor Fitzgerald has introduced a novel Bitcoin investment vehicle designed to capture cryptocurrency upside while mitigating volatility through gold exposure. The Cantor Fitzgerald Gold Protected Bitcoin Fund, unveiled at May's Bitcoin 2025 conference, represents institutional finance's latest bridge between digital assets and traditional safe havens.

Gold's record-breaking performance near $3,680 per ounce contrasts with Bitcoin's current 9% retreat from last month's all-time high. "This strategy spans five years to capture Bitcoin's upward trajectory while using gold as a historical hedge during market declines," said Bill Ferri, Global Head of Cantor Fitzgerald Asset Management. The move comes as both risk assets and haven assets test peak valuations.

MicroStrategy Doubles Down on Bitcoin with $217M Purchase Amid Market Hesitation

MicroStrategy has added another 1,955 Bitcoin to its treasury, spending $217.4 million in early September as the cryptocurrency traded around $110,000. The purchase brings the company's total holdings to 638,460 BTC, now valued at over $71 billion.

CEO Michael Saylor continues to execute his unshakable accumulation strategy, leveraging share sales and preferred securities to fund the buys. "We've demonstrated the power of our approach," Saylor noted in SEC filings, highlighting the company's substantial unrealized gains.

The move coincides with ongoing Bitcoin acquisitions by nation-states and institutional players. El Salvador and Japanese firm Metaplanet remain active buyers, signaling growing institutional conviction despite price volatility.

Solo Bitcoin Miner Defies Odds with $347K Block Reward in 2025

A solo Bitcoin miner has achieved a rare feat in the highly competitive world of cryptocurrency mining, securing a block reward worth over $347,000. The miner processed block 913,632 using Solo CKPool, a service that enables individuals to mine without operating a full bitcoin node. The reward comprised 3.125 BTC plus 0.0042 BTC in transaction fees, totaling approximately $347,872 at current prices.

The block included 593 transactions valued at $52.6 million, highlighting the scale of activity on the Bitcoin network. This marks the second time this month an independent miner has outperformed industrialized mining operations, which typically dominate with specialized ASIC rigs and distributed workloads.

Solo mining remains a high-stakes gamble as individuals compete against pooled resources. The difficulty adjustment mechanism, recalibrated every 2,016 blocks, ensures the network maintains its 10-minute block time—a testament to Bitcoin's decentralized design.

Athena Bitcoin Faces Legal Action Over Elderly Scam Allegations

Washington, D.C. Attorney General Brian L. Schwalb has filed a lawsuit against Athena Bitcoin, Inc., accusing the Bitcoin ATM operator of enabling scams targeting elderly residents. The company allegedly failed to disclose excessive fees and ignored fraudulent activities, violating the Consumer Protection Procedures Act.

Athena operates 4,100 Bitcoin ATMs across five countries. Despite the legal scrutiny, its over-the-counter stock rose 8.5% to $0.02 on Monday, though it remains down 83% year-to-date.

Bitcoin ATMs have become a favored tool for scammers due to the irreversible nature of crypto transactions. Victims, often unfamiliar with cryptocurrencies, are frequently exploited through these machines.

Ordinals Developer Threatens Bitcoin Core Fork Over Censorship Concerns

A rift is widening in the Bitcoin community as Leonidas, lead developer of Bitcoin Ordinals, threatens to fork Bitcoin Core if network updates favoring Ordinals and Runes are rolled back. The ultimatum, delivered via an open letter on X, underscores growing tensions between advocates for uncensored transactions and critics who view non-financial data as network spam.

Ordinals and Runes enable media storage on Bitcoin's blockchain—a feature hailed by some as innovation and derided by others as a departure from Bitcoin's peer-to-peer cash ethos. Leonidas warned his 'DOG Army' would fund an open-source fork stripping most policy rules to ensure censorship-resistant transactions. 'Thousands will run this fork to make it a reality,' he declared.

Germany Misses Out on $5B in Bitcoin Linked to Movie Piracy Site

Arkham Intelligence reports that approximately 45,000 BTC tied to the defunct Movie2K piracy platform remain unseized by German authorities. The dormant wallets, untouched since 2019, now hold nearly $5 billion at current prices.

Legal hurdles complicate recovery efforts. Prosecutors must establish direct links between the bitcoin and criminal activity—a high evidentiary bar given the pseudonymous nature of blockchain transactions. The funds exhibit movement patterns consistent with earlier Movie2K-associated addresses identified in prior investigations.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, BTCC financial analyst Emma provides this outlook: 'The convergence of institutional adoption, macroeconomic factors, and Bitcoin's hardening value proposition suggests significant long-term appreciation potential. Our analysis incorporates current momentum, historical cycles, and increasing institutional allocation trends.'

| Year | Conservative Target | Moderate Target | Bullish Target | Key Drivers |

|---|---|---|---|---|

| 2025 | $125,000 | $150,000 | $180,000 | Fed rate cuts, ETF inflows, halving effects |

| 2030 | $250,000 | $350,000 | $500,000 | Institutional adoption, regulatory clarity, scarcity premium |

| 2035 | $500,000 | $750,000 | $1,200,000 | Global reserve asset status, technological maturation |

| 2040 | $800,000 | $1,500,000 | $2,500,000 | Full monetary digitization, store-of-value dominance |